Market Outlook July 2025

The outlook for the UK economy remains downbeat for the rest of this year and most of 2026, but with better overall growth in GDP now forecast from 2027 onwards.

The latest GDP forecast is an increase of 1% for 2025, and 1.1% for 2026 before average increases of 1.5% from 2026 to 2029. Inflation forecasts are currently 3.2% at the end of 2025, before reducing to 2.5% by the end of 2026.

Growth levels have continued to slow since the middle of 2024, albeit with the construction sector now outperforming the economy overall. There has also been a recent slight increase in the amount of positivity in the construction sector, as evidenced by recent UK Construction Purchasing Managers’ Index surveys, a general indicator of construction industry sentiment, having fallen below 50 in January and then further in February.

It has risen for the last 4 months, despite still remaining below 50, the threshold between growth and contraction. This small improvement shows a recent increase in overall construction activity, with new work orders and output rising over the last quarter.

The Government’s recent spending review was generally positive for the construction industry promising increased investment in built assets over the next 10 years, with a focus on the defence, health and transport sectors. Simplification of planning and other regulations were also noted in an attempt to stimulate private castor involvement either directly or in partnership with public bodies.

The recent increases in inflation (CPI) to 3.4% in May, resulting from increased utility and council tax bills, is unlikely to lead to a further 0.25% reduction in Base Rate by the Bank of England in July as widespread national and international economic concerns remain, with the conflicts in Ukraine and the Middle East ongoing and the impact of trade tariffs by the US still to be fully resolved.

It is likely that in the short term the bank will adopt a more cautious approach as inflation stays above the often stated 2% target, which is now expected to be reached in 2027.

Local Outlook

Looking at Scotland in general, the construction sector continues to suffer from lower demand than South of the Border, with the view on anticipated pipelines of projects going to tender over the next 12 months remaining the same as the last quarter. 80% of companies forecasted either an increase in opportunities or unchanged position rather than a reduction.

Contractors’ interest in tendering for projects remains mixed, and very project specific, with projects of less than £5 million being the more attractive, with an appropriate tender list usually being achievable after searching. However, there appears to be less interest from tier one contractors for higher value projects at present, with growing uncertainty in tender returns as more companies either pull out during the process or fail to submit a tender return.

Tender interest also continues to vary significantly by location, value and sector with significant issues being experienced in the more outlying parts of the country, driven predominantly by supply chain and logistical issues and particularly evident in the Highlands & Islands at present.

The choice of tender route is now also being seen as key factor in interest, with single stage tendering being either welcomed by contractors to increase opportunities or avoided to focus on working with existing clients or within specific sectors.

The Scottish BCIS panel noted that while some confidence has returned it is not back to pre-Covid levels and the lack of clarity on future pipelines of work, ongoing labour and skill shortages and uncertainty over future funding level remains a significant impediment to projects progressing at the moment.

Summary of Forecast

The following forecasts are based on a middle of the road set of assumptions with regards to trade restrictions and economic performance by the UK economy as a whole. However, the figures could vary by up to 15% (+/-) per annum over the period of the forecast.

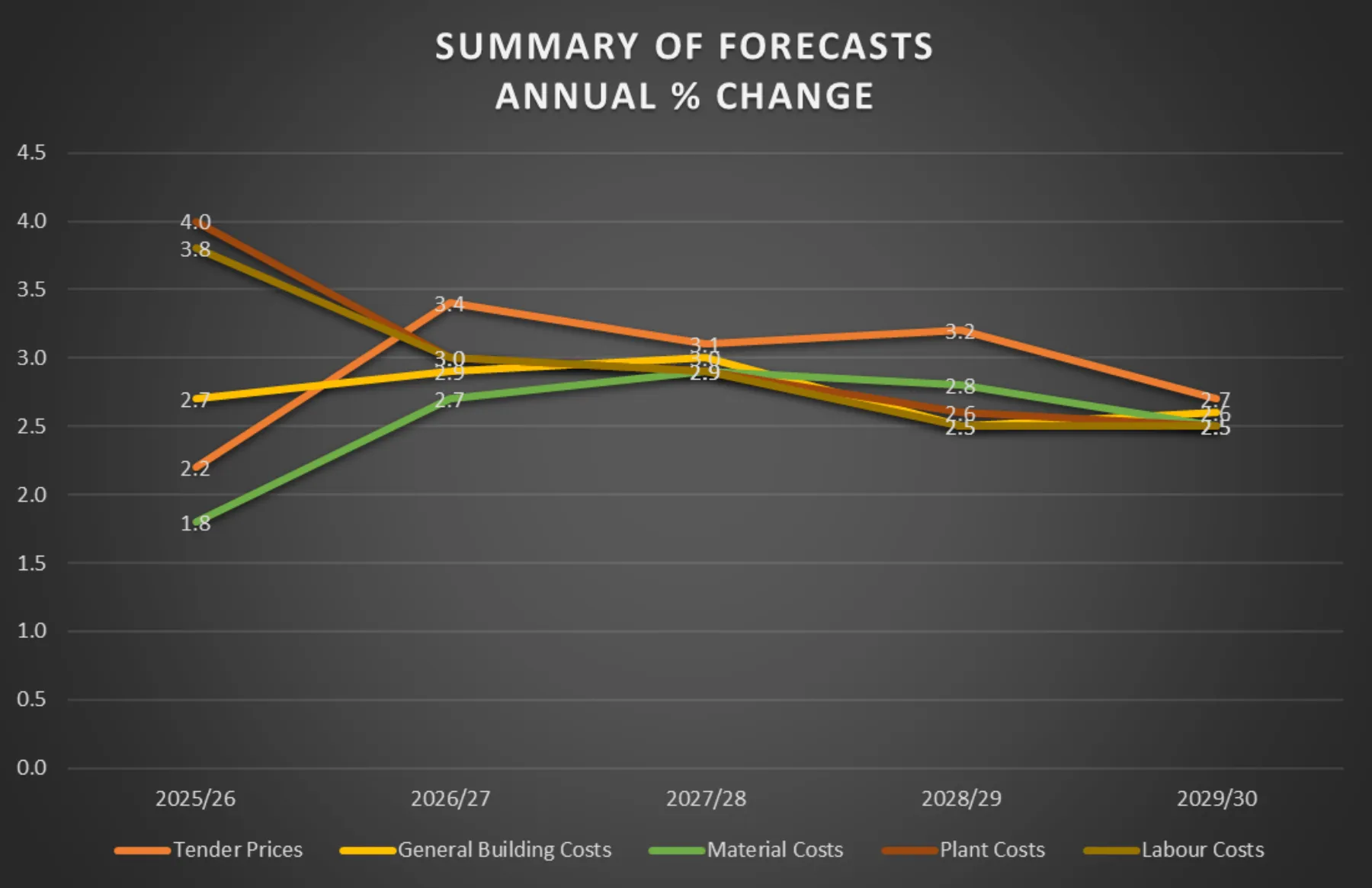

The forecast movements in construction costs currently shown in the BCIS Quarterly Report are as follows:

Overall, UK Tender prices rose by 0.5% over the last quarter, with a rise of 0.9% identified in Scotland. The annual rise remained unchanged at 2.3% (3.4% in Scotland) when compared with the same quarter in 2024.

The overall view of the UK TPI panel was marginally more optimistic than reported in the previous quarter, with the view that tender price increases are likely to increase to an average of 3% per annum over the period of the forecast.

There continues to be widespread evidence of a differential in the movement of tender prices between M&E and general building works, with a limited pool of skilled labour routinely cited as the main factor, resulting in a lack of competitiveness through a restricted market place, particularly evident on larger projects in Scotland at present, with the energy sector drawing resources from other areas.

The level of competitive pricing currently being experienced has declined slightly from the last quarter, with Contractors being more selective on what they will price. Over the next five years tender prices are currently forecast to rise by 15% overall, a 1% increase compared to the last forecast, now at the same rate as building costs, with concerns as to future pipelines of work remaining.

Building costs rose by 0.4% in the last quarter when compared to the previous quarter and by 3.5% from the same quarter a year ago, a decrease of 1.8% from the 5.3% reported in the last forecast. These costs are forecast to rise by approximately 15% in total over the next 5 years, a decrease of 2% from the previous forecast, with more moderate increases in labour and material costs now being anticipated.

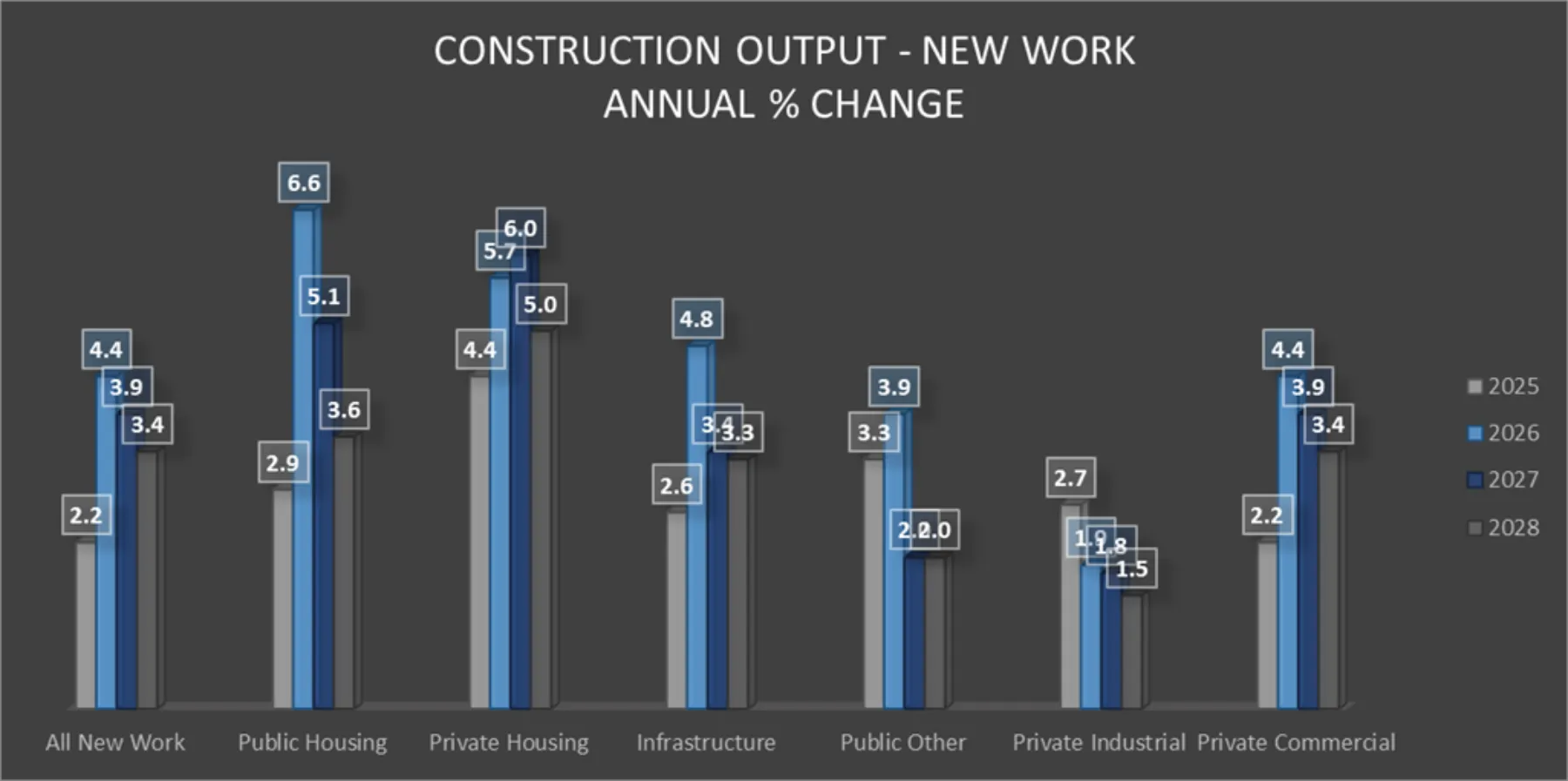

Construction Output

New work output declined by 5.1% in 2024 with growth of 2.8% forecast for 2025, followed by higher increases of 4%-5% per annum over the next couple of years, driven predominantly by the housing sector, but with infrastructure, industrial and commercial forecasts remaining subdued.

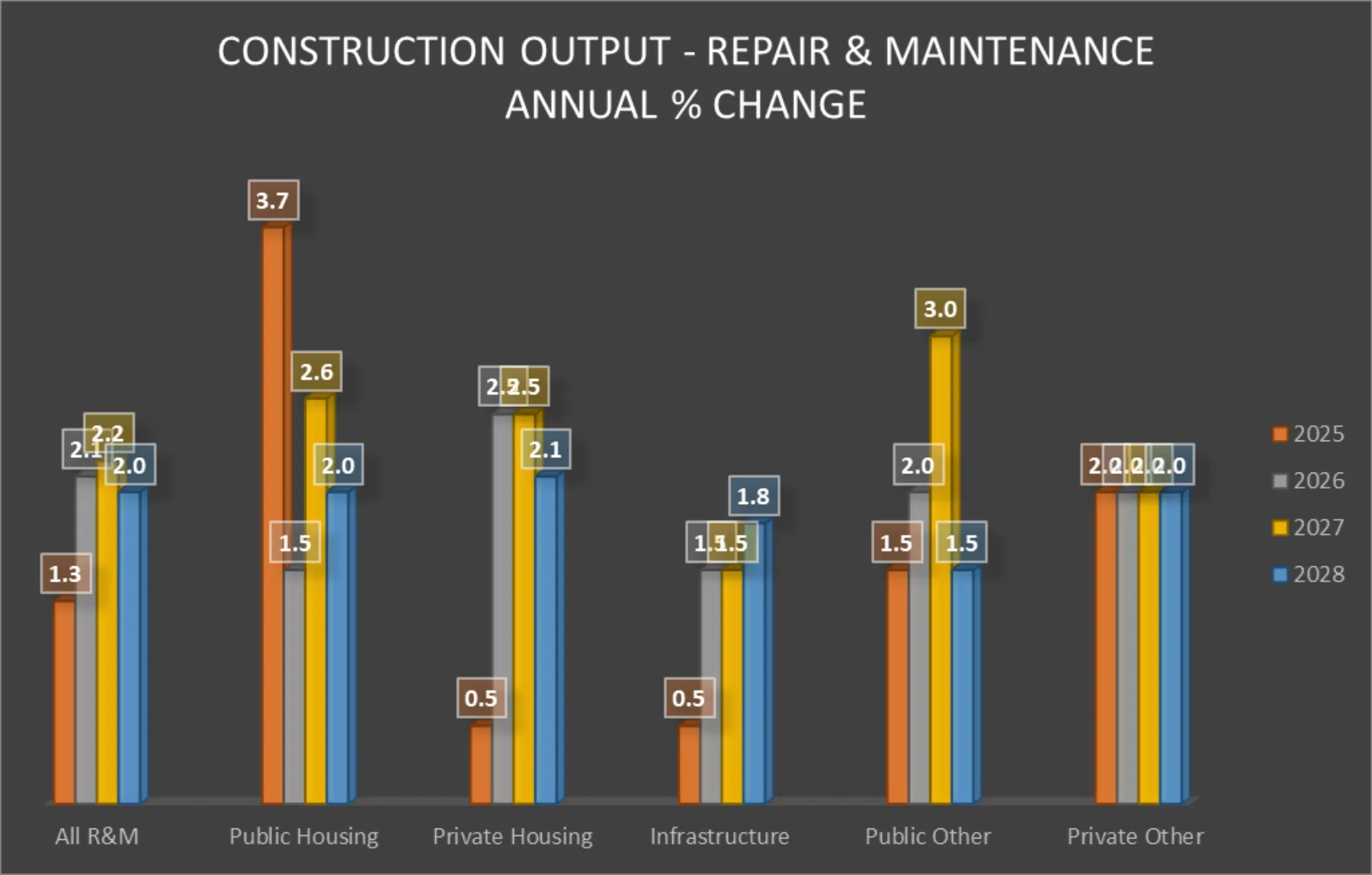

There was however a slightly better picture for the repair and maintenance sector, with an annual increase of 8.7% in 2024, but with growth rates expected to reduce over the period of the current forecast. Annual increases are expected to range from 1.3% - 2.2%, as shown in the graph below.

Conclusion

The market views in construction have improved slightly since the last forecast, however both domestic and international economic issues are reducing confidence in the short to medium term. It remains a common view that 2025 will be another difficult year for construction with only minimal output growth evident before growth accelerates from late 2026 onwards.

Whilst there is some cause for optimism, real improvement will depend on the implementation of both the Scottish and UK Governments spending plans to drive construction growth, as despite the cost of borrowing reducing there is currently no real evidence of increased levels of investment in built assets by the private sector.

Sign up for news

Receive email updates from Thomson Gray direct to your inbox:

- Subscribe to Practice News

- Subscribe to Market Outlook