Market Outlook April 2024

The outlook for the economy as a whole is still fairly subdued for the next couple of years, with a protracted recession now looking unlikely following the latest GDP figures, which showed a slight increase in February.

Output in 2024 is still expected to fall further with a gradual recovery is expected from 2025 onwards, albeit slower than previously forecast. The period of high inflation (CPI) would now appear to be past but, at 3.4% in February, it is still well above the Government’s 2% target, the downward trend is expected to continue through 2024, increasing the prospect of gradual interest rate reductions by the Bank of England from the middle of this year.

Market Outlook

The UK construction sector is currently experiencing lower demand, particularly in the private housing sector, along with increasing input costs, particularly in relation to labour costs in 2023. The ongoing conflicts in Ukraine and the Middle East and the attacks on shipping in the Red Sea have only added to the levels of uncertainty in the short term.

Locally, contractors’ interest in tendering for projects remains buoyant. We would note that contractors still are cautious about which opportunities to pursue, with large complex projects appearing to be increasingly unattractive.

The following forecasts are based on a middle of the road set of assumptions with regards to trade restrictions and economic performance by the UK economy as a whole. However, the figures could vary by up to 15% (+/-) per annum over the period of the forecast.

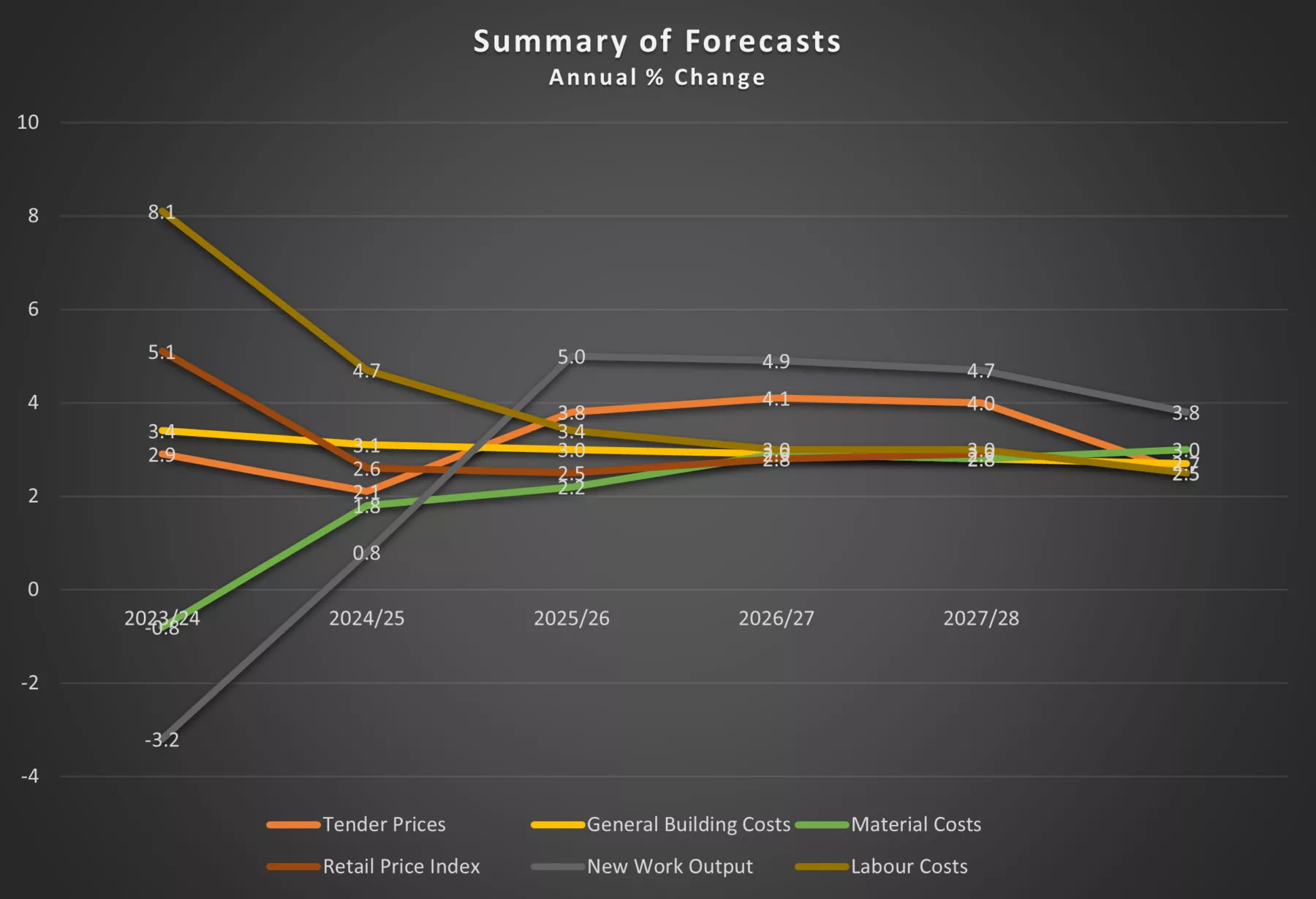

Summary of Forecast

The forecast movements in construction costs currently shown in the BCIS Quarterly Report are as follows:

Overall, UK tender prices rose by 0.5% over the last quarter, with a rise of 1% identified in Scotland. However, the annual rise dropped by a further 0.6% to 2.9% (4% in Scotland) when compared with the same quarter in 2023. A substantial number of respondents to the recent TPI survey identified an increased interest in new opportunities, particularly with several pipelines of work being either delayed or cancelled.

The forecast for the following 5 years shows tender price increases of around 2.1% in 2024 and then varying between 2.5% and 4.1% per annum over the rest of the forecast period. The level of competitive pricing currently being experienced is likely to continue well into 2025 and it is only then that tender prices will rise faster than costs. Over the next five years tender prices are currently forecast to rise by 17% overall, a 1% increase compared to the last forecast.

Building costs rose by 0.2% in the last quarter when compared to the previous quarter and by 2.7% from the same quarter a year ago, mainly due to increasing labour costs, halting the downward trend from the peak of over 14% seen in mid-2022. Overall, costs are expected to continue to rise over the next 5 years, with increases around 3.1% in 2024 and then remaining at around 2.8% from 2025 for the rest of the current forecast period. Building costs are forecast to rise by 15% in total over the next 5 years, an increase of 1% from the previous forecast.

Total new work construction output fell by 2.1%. A further reduction of up to 3% is forecast in 2024. Nominal growth of 0.8% is expected in 2025, with increases of 5% per annum for 2026 to 2029.

Conclusion

2024 continues to look challenging for the construction sector in Scotland, with impact of reduced public sector expenditure on construction and subdued private sector demand being felt across the supply chain.

The UK General Election may improve the situation as all the main parties are committed to increasing housing supply and other major construction / infrastructure projects, but the impact will be minimal in the short term as funding constraints will determine the timescales for delivery.

Sign up for news

Receive email updates from Thomson Gray direct to your inbox:

- Subscribe to Practice News

- Subscribe to Market Outlook