Market Outlook January 2024

The outlook for the economy as a whole remains fairly pessimistic, with a recession a distinct possibility following the latest GDP figures. In the construction sector total output fell in 2023 and is expected to fall further in 2024.

However, a gradual recovery is expected from 2025 onwards, albeit slower than previously forecast. Inflation (CPI) in December was 4.2% per annum, down a further 2.5% from September. However even with a further reduction in December 2023 it is still well above the Government’s 2% target, a level it is not expected to return to until 2025 at the earliest, reducing the prospect of meaningful interest rate reductions by the Bank of England in 2024.

Market Outlook

Looking at the UK as a whole the construction sector is suffering through lower demand and increasing input costs, particularly in relation to labour costs in 2023. In theory this should lead to more competitive tender returns but can also result in increased levels of contractor insolvency.

Locally, the willingness to tender for projects would appear to be on the increase, as we continue to receive regular enquiries from contractors about tender opportunities in 2024. We note however, that contractors remain selective about which projects to tender for. Factors such as the client or risk level are being given careful consideration along with the procurement route, with negotiated or short two stage tenders being preferred to traditional competitive tenders.

The following forecasts are based on a middle of the road set of assumptions with regards to trade restrictions and subdued economic performance by the UK economy as a whole. However, the figures could vary by up to 15% (+/-) per annum over the period of the forecast depending on the on-going implications of Brexit on trade, the extent of continuing material shortages, escalation of the war in Ukraine and conflict in the middle east.

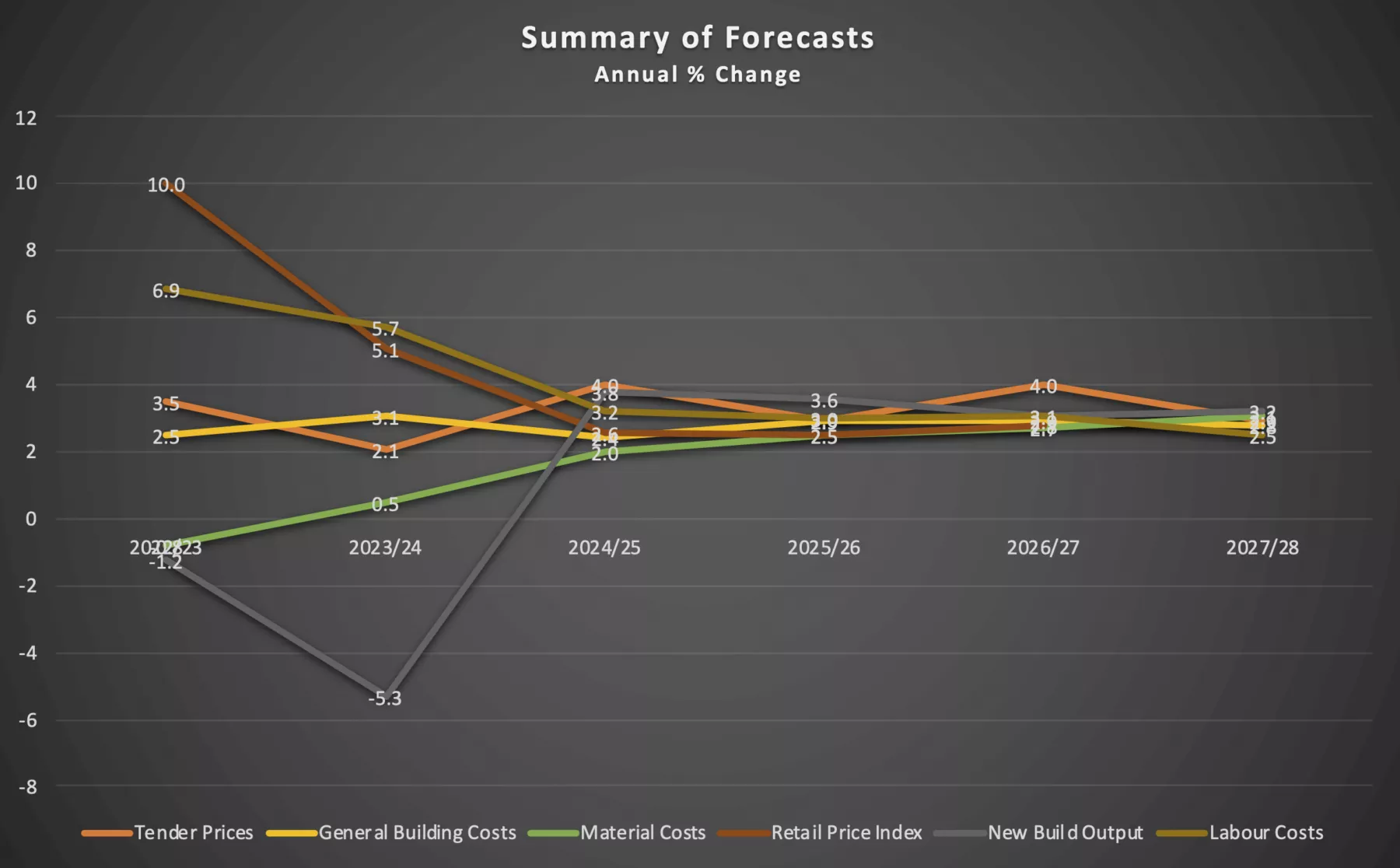

Summary of Forecast

The forecast movements in construction costs currently shown in the BCIS Quarterly Report are as follows:

Overall, UK Tender prices rose by 0.6% over the last quarter, with a rise of 1% identified in Scotland. However, the annual rise dropped by a further 0.6% to 3.5% (5% in Scotland) when compared with the same quarter in 2022 . Over 50% of respondents to the recent TPI survey identified a distinct difference in the movement between building and M&E work, something that has become more evident over 2023, potentially rising from lack of competition and capacity constraints.

The forecast for the following 5 years indicates tender price increases of around 2.1% in 2024 and then alternating between 2.9% and 4.0% per annum over the remainder of the forecast period. Decreasing demand and delays / cancellation of current projects will see companies looking to secure their pipeline for 2024/25 which will lead to more competitive pricing in the short term. Over the next five years tender prices are currently forecast to rise by 16% overall, a 2% decrease compared to the last forecast.

Building costs rose by 0.3% in the last quarter when compared to the previous quarter and by 2.5% from the same quarter a year ago, continuing the downward trend from the peak of over 14% seen in mid-2022. Overall, costs are expected to continue to rise over the next 5 years, with increases around 3.1% in 2024 and then remaining at around 3.0% from 2025 for the remainder of the current forecast period. Building costs are forecast to rise by 14% in total over the next 5 years, a reduction of 1% from the previous forecast.

Total construction output increased by 2.5% in 2023, with new construction work falling by 0.9% and Repair & Maintenance work increasing 7.8%. A further reduction of up to 6% is forecast in 2024. Growth is expected to return in 2025, with an overall increase of 8% over the period to 2028.

Conclusion

2024 is looking like a challenging year for the construction sector in Scotland, with the combination of public sector budget cuts in capital expenditure announced in the latest budget and lower private sector demand particularly in the private housing sector taking effect.

The upcoming UK general election may change the medium-term outlook, but it is likely to have negligible impact until 2025/26 given lead times for major projects.

Sign up for news

Receive email updates from Thomson Gray direct to your inbox:

- Subscribe to Practice News

- Subscribe to Market Outlook