Market Outlook July 2023

The impact of the ongoing war in Ukraine and high energy prices continue to have a significant impact on the economy with inflation (CPI) in May at 7.9% per annum, albeit down from a high of 10.4% in February.

Even with further reductions forecast over the rest of 2023 to 6.8% it is still well above the Government’s 2% target, a level it is not expected to return to until 2025 at the earliest. This could lead to further interest rate rises by the Bank of England this year, possibly to above 5% by the end of 2023, although the effectiveness of this policy is now being more widely questioned.

Market Outlook

Looking at the UK as a whole the market would appear to be changing as input cost pressures ease and demand softens, which should lead to more competitive tender returns allowing investors to take marginal projects forward to construction. However, this is not very evident locally, with widespread of evidence of Contractors being selective in returning tenders and prices staying well above expectations.

Although the UK Economy has technically avoided going into recession so far this year, economic performance has been poor, not helped by widespread industrial action in the first half of the year. The indicators for future inflation level remain mixed with the large drop in input costs being advised by manufacturer’s being more than offset by high wage growth, predominantly in the services sector.

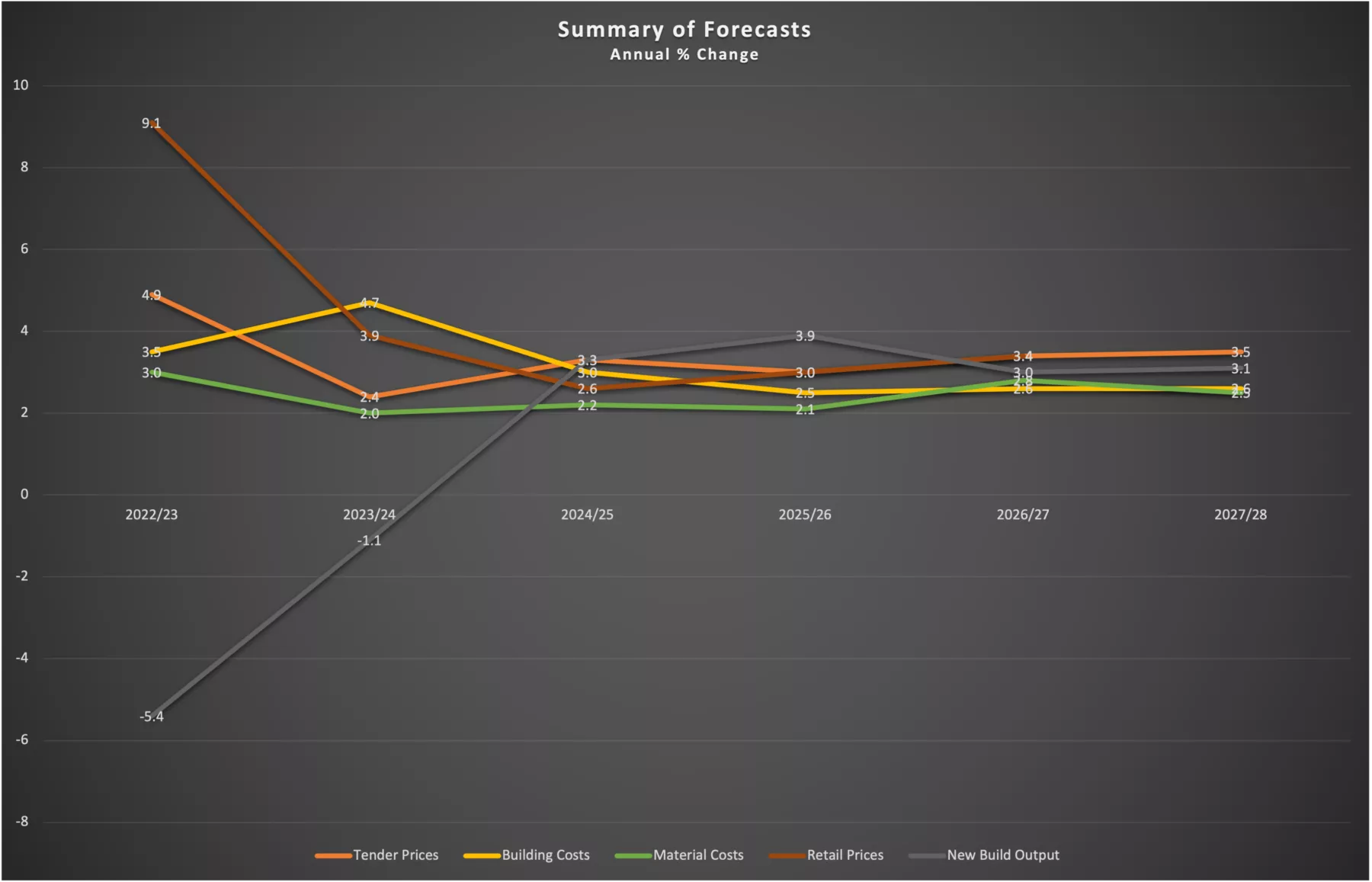

The following forecasts are based on a middle of the road set of assumptions with regards to trade restrictions and subdued economic performance by the UK economy as a whole. However, the figures could vary by up to 15% (+/-) per annum over the period of the forecast depending on the medium-term implications of Brexit on trade, the extent of continuing material shortages, and any escalation of the war in Ukraine.

Tender prices rose by 1.1% over the last quarter, a similar increase to the previous quarterly rise. However, the annual rise dropped by 1.5% to 4.9% when compared with the same quarter in 2023. Tender prices have been rising since the second quarter of 2020, but the rate of increase is forecast to increase further to 6.9% by early 2023 driven by strong cost pressures currently being experienced.

The forecast for the following 4 years indicates lower tender price increases of around 2.5% in 2023 and 3% per annum over the remainder of the forecast period. Decreasing demand and fewer opportunities will lead to more competitive pricing, with contractors absorbing some of the predicted increases in site labour costs in the short term. Over the next five years tender prices are currently forecast to rise by 21% overall, a 2% decrease compared to the last forecast.

Building costs rose by 2.0% in the last quarter when compared to the previous quarter and by 8.1% from the same quarter a year ago, with the annual increase continuing to reduce from the peak of over 14% seen in mid-2022. Overall, costs are expected to continue to rise over the next 5 years, with increases around 4.5% in 2023 reducing to 2.5% per annum from 2024 for the remainder of the current forecast period. Building costs are forecast to rise by 16% in total over the next 5 years, a reduction of 2% from the previous forecast.

Total construction output increased by 4.4% in 2022. New construction work is expected to reduce by up to 6% in 2023-2024, mainly as a result of a 16% reduction in the private housing sector. Growth if expected to return in 2025, with an overall increase of 13% over the forecast period to 2028, driven by increasing investment in the infrastructure sector.

Expenditure on repair and maintenance is also forecast to continue to increase by around 2% per annum, this is being driven by non – housing work as organisations continue to maintain their existing estates as a more economic option to new buildings.

Conclusion

The market appears to be at a turning point with both input costs and demand falling which should see a more competitive tendering environment with increases in tender prices softening allowing more projects to progress.

Sign up for news

Receive email updates from Thomson Gray direct to your inbox:

- Subscribe to Practice News

- Subscribe to Market Outlook